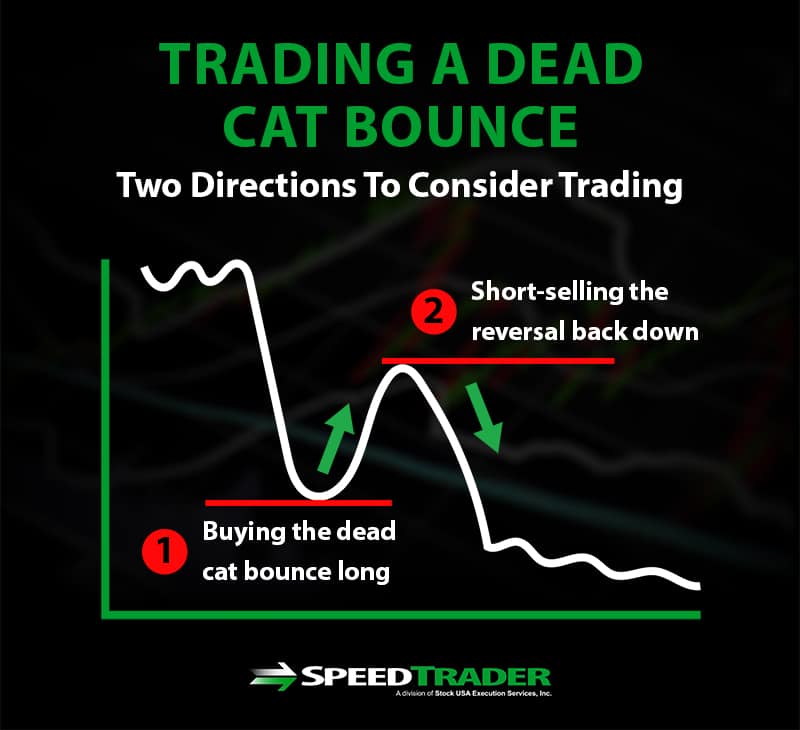

The pattern represents a price pick up in the time of the bearish trend. A dead cat bounce is a small and temporary recovery in a financial market following a large fall.

What Do You Mean By Dead Cat Bounce General Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

What Do You Mean By Dead Cat Bounce General Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

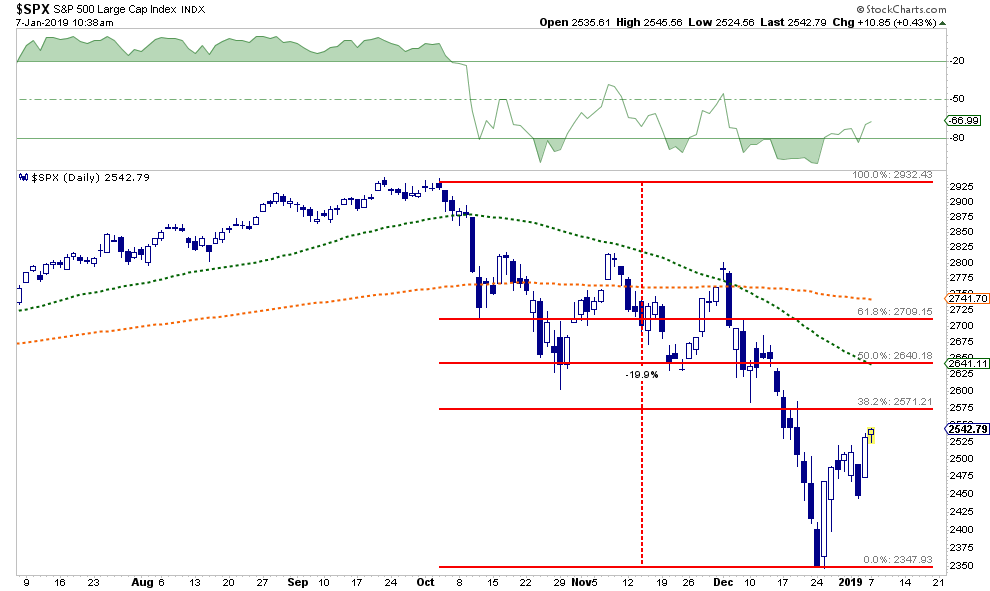

A dead cat bounce is when the price gaps down 5 or more continues to decline after the open but then has a rally.

What does dead cat bounce mean in stock. A small knee-jerk rally in one of the financial markets. The psychology behind the pattern is that the initial short sellers consider that the stock has hit a bottom. In finance a dead cat bounce is a small brief recovery in the price of a declining stock.

Derived from the idea that even a dead cat will bounce if it falls from a great height the phrase which originated on Wall Street is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. A dead cat bounce is a short-term recovery in a declining trend that does not indicate a reversal of the downward trend. This gives investors the idea that a certain stock is in recovery or that the market is experiencing a correction.

Watch for the price to rally back into the vicinity of the open price. But in most cases the stock is really on the verge of collapsing. A Dead Cat Bounce is a technical trading pattern thats unique to stock forex and commodities bear markets whereby a swift drop is followed by a small short-lived recovery before another brutal drop takes over.

Table of Contents show. Derived from the idea that even a dead cat will bounce if its dropped from high enough a dead-cat bounce occurs when there has been a temporary rebound after if a stock has a prolonged stretch of bearishness. A Dead Cat bounce is an upside momentum witnessed after a prolonged downward trend generally near the oversold price region.

A dead cat bounce is a stock market phenomenon where continuous down trends are interrupted by small spikes. Dead Cat bounce is a colloquial phrase which is quite popular in the financial markets. In finance a dead cat bounce is a small brief recovery in the price of a declining stock.

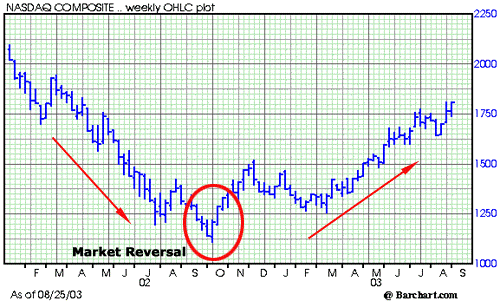

The phrase denotes a recovery in the assets price often a sharp one after a prolonged downtrend. It is considered a continuation pattern where at first the bounce may appear to be a reversal of the prevailing trend but it is. It is a temporary rally in the price of a security or an index after a major correction or downward trend.

To the savvy investor the sight of a dead cat. But it is to be noted that this price bounce is merely a reaction of the downtrend which is often witnessed in the oversold areas. Sometimes it is also referred to a short but sharp fall succeeded by an equally sharp recovery.

However after the increase the price drops further breaking its lower bottom. The expression is originated in the UK during the financially turbulent 1980s. Refers to a stock index or security price that bounces up only slightly after a precipitous fall.

This is once again a guide. The dead cat bounce is a pattern which occurs during bearish price moves. A dead cator any other animalwill bounce only slightly after being dropped.

This Pattern is largely considered an indicator of continuing market weakness. Reasons for a dead cat bounce include a clearing of short positions. A dead cat bounce happens when a declining stock suddenly regains some of its value only to fall even further soon after.

The term was coined a long time ago and generally referred to the peculiar behaviour of the price. A dead cat bounce is A bull marketis when a great investments price is risingcalled an uptrendtypically over a continual period such like months or years. Its an illusory gain brought on by short term fluctuations in the market.

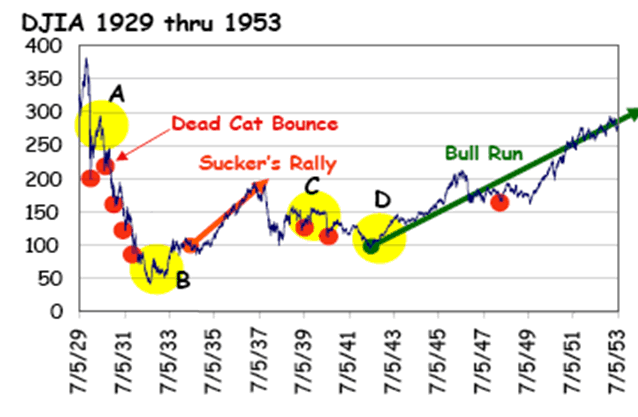

Dead Cat Bounce is a market jargon for a situation where a security read stock or an index experiences a short-lived burst of upward movement in a largely downward trend. A dead cat bounce is a price pattern used by technical analysts. The sucker rally is just long enough to attract unsuspecting buyers back into the market due to FOMO or fear of missing out as things suddenly begin rising again.

Derived from the idea that even a dead cat will bounce if it falls from a great height the phrase which originated on Wall Street is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. Whats the origin of the phrase Dead cat bounce. To many investors a dead cat bounce is the final sign its time to let go of the float shares you are holding and look onward to the next investment.

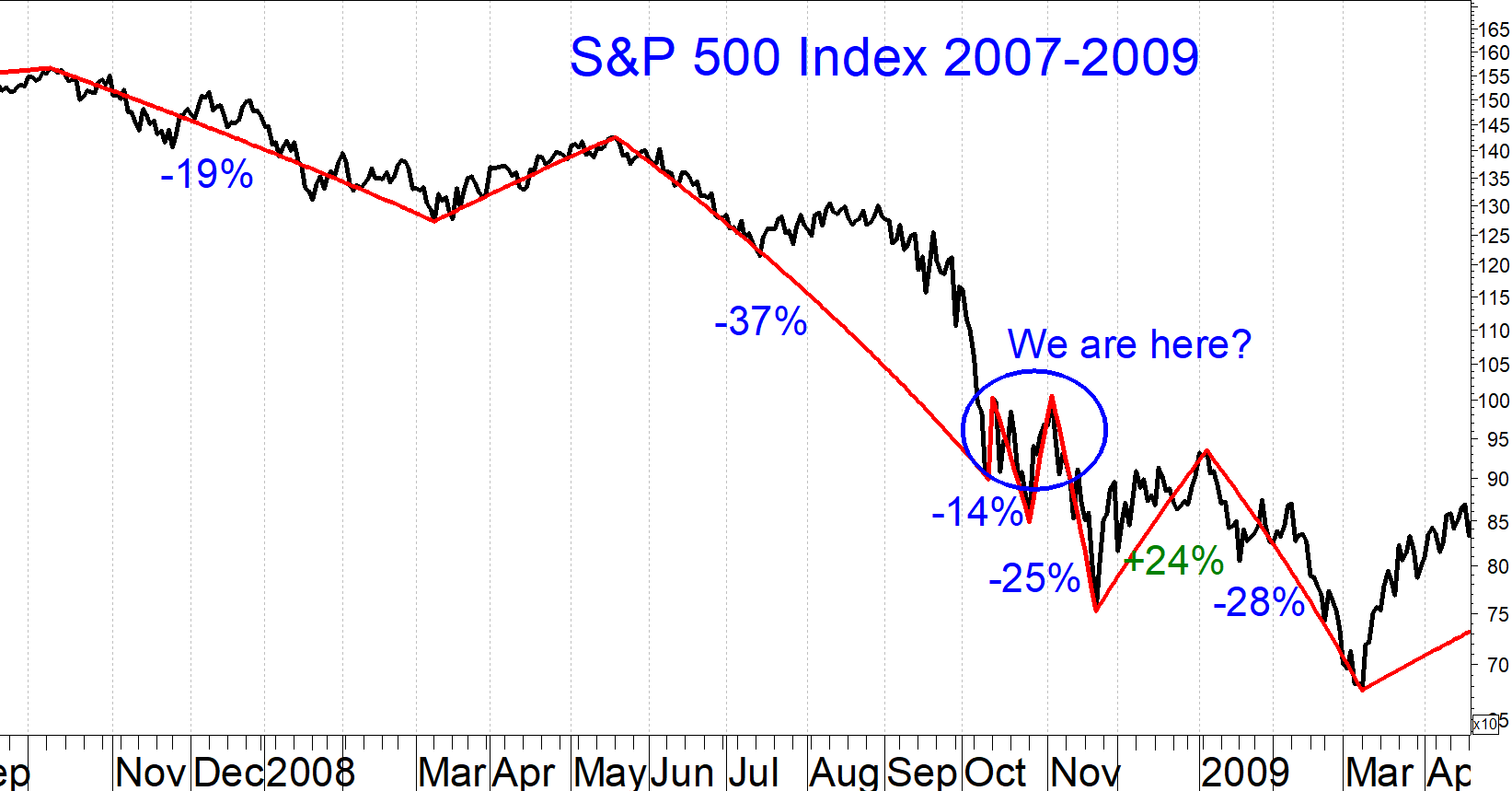

The dead cat bounce or sucker rally is nothing more than a temporary rise in asset prices following a deep dive which could be exactly whats happening this morning. The area around the open price is likely to be a resistance level.

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

Dead Cat Bounces And How To Spot Them

Dead Cat Bounces And How To Spot Them

Does This Chart Closely Resemble A Classic Dead Cat Bounce Personal Finance Money Stack Exchange

Does This Chart Closely Resemble A Classic Dead Cat Bounce Personal Finance Money Stack Exchange

Technically Speaking Return Of The Bull Or Dead Cat Bounce Seeking Alpha

Technically Speaking Return Of The Bull Or Dead Cat Bounce Seeking Alpha

Dead Cat Bounce What Is It How Can You Profit From It

Dead Cat Bounce What Is It How Can You Profit From It

The Black Art Of Predicting Stock Market Dead Cat Bounces One More For S P 500 The Market Oracle

What Is A Dead Cat Bounce Definition Explanation And Trading Guide

What Is A Dead Cat Bounce Definition Explanation And Trading Guide

The Phrase Dead Cat Bounce Meaning And Origin

The Phrase Dead Cat Bounce Meaning And Origin

Was This A Dead Cat Bounce The Irrelevant Investor

Was This A Dead Cat Bounce The Irrelevant Investor

Stock Market Dead Cats Are Bouncing Knappily

Stock Market Dead Cats Are Bouncing Knappily

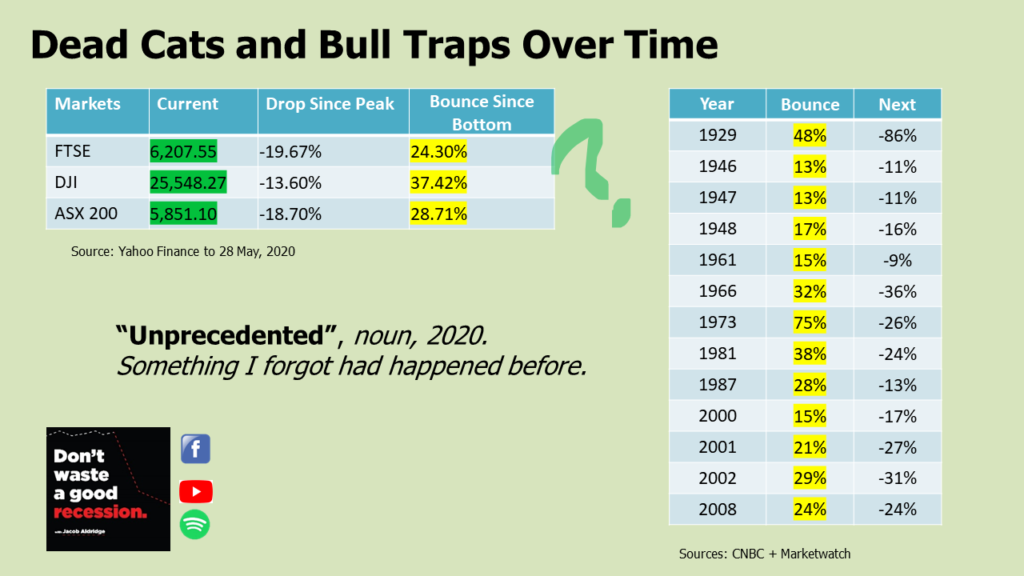

Is This A Dead Cat Bounce Jacob Aldridge

Is This A Dead Cat Bounce Jacob Aldridge

Watch Out For The Dead Cat Bounce London Stone Securities

Watch Out For The Dead Cat Bounce London Stone Securities

The Dead Cat Bounce Of Investing

Dead Cat Bounce Rally May Be First Of Many

Dead Cat Bounce Rally May Be First Of Many

Was Today S Stock Market Performance A Dead Cat Bounce 02 03 2020 Quora

Dead Cat Bouce Dead Cat Bounce Meaning Cat Bounce

Dead Cat Bouce Dead Cat Bounce Meaning Cat Bounce

Dead Cat Bounce Yay Or Nay Poems

Dead Cat Bounce Yay Or Nay Poems

Post a Comment

Post a Comment